“I can name at least four IPO-bound startups whose financials are delayed because the auditors are refusing to sign on their books, after discrepancies were found in their annual filings,” Sathya Pramod, who founded KayEss Square Consulting Pvt Ltd, told Inc42.

And this epitomises the new wave of corporate governance problems plaguing Indian startups.

Are Indian startups in the crosshairs? Not all of them, certainly, but a good number of tech startups have run into a rough patch with auditors and even whistleblowers flagging various irregularities, driving skeletons out of the closet.

The first four months of 2025 have seen multiple instances of financial misreporting, revenue inflation, , boardroom wars, and VCs dragging founders to courts. The most recent came up when Deloitte put a disclaimer on the delayed FY24 financial statement of VerSe Innovation that could possibly impact its standalone FY24 financials and not consolidated financials.

Although the Big Four auditor did sign the FY24 figures of the unicorn, it controls were weak, there were concerns on revenue recognition, possible theft of assets, and so on. The standoff turned the spotlight back on how the new-age companies were struggling to keep their slates clean.

“Disclaimers in the financial statements won’t help,” Pramod said.

“We often see cases of accounting frauds and misreporting of financial figures. Will a disclaimer from the auditor do systemic cleaning? The answer is no.” said Pramod, who has spent more than 20 years in consulting while working for big names like Deloitte, EY, AOL, and Tally.

The issue escalated when Deloitte’s flagging of irregularities coincided with a churn in VerSe’s finance team, including the exit of its chief financial officer.

Unicorns Feel The Corporate Governance HeatThe dynamics of the industry can be observed best in late-stage startups, especially unicorns and soonicorns, that raise billions of dollars from venture capitalists (VC) both within and outside India.

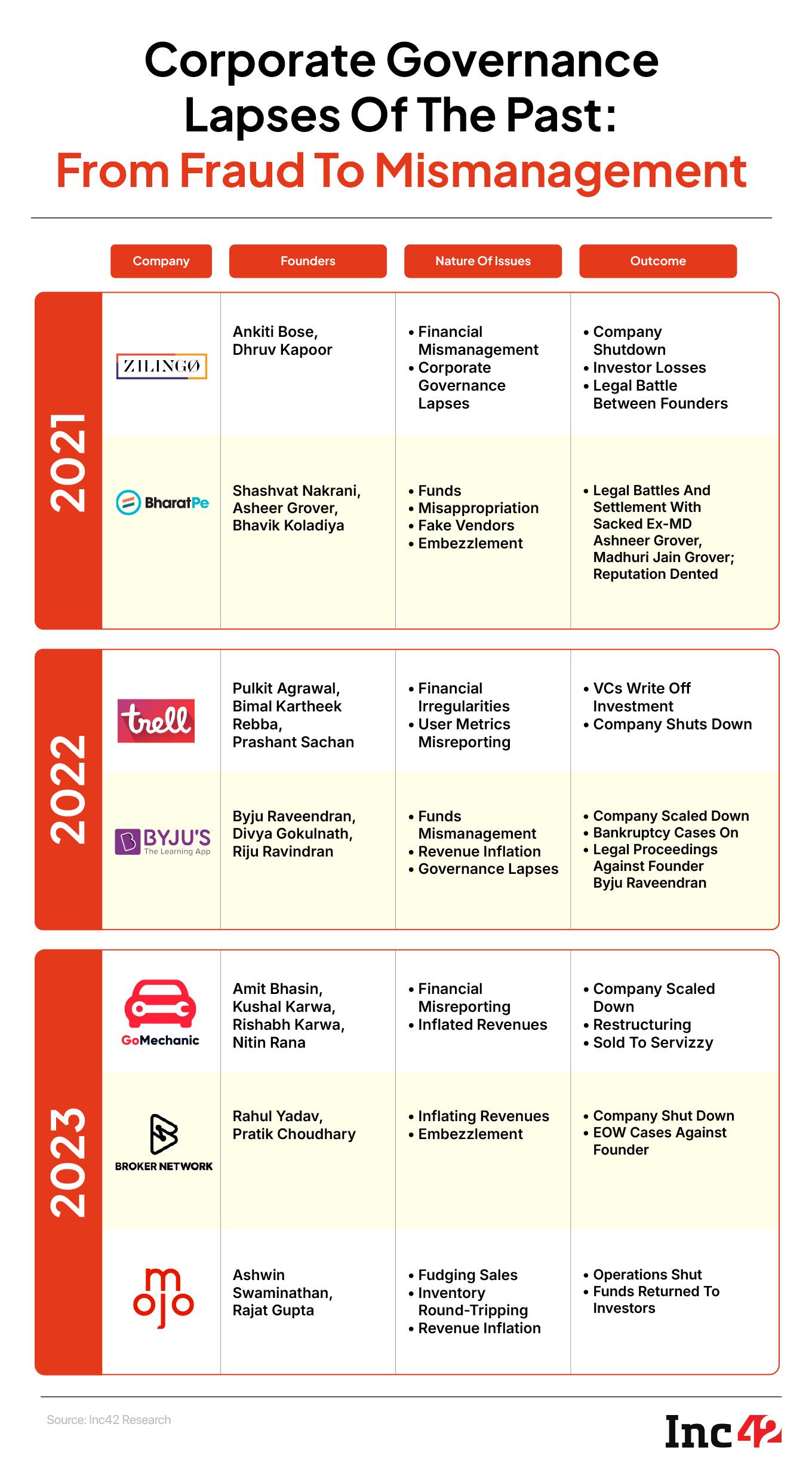

When the lid was blown off their corporate governance gaps and lapses, flagship ventures came under the lens, such as , BYJU’S, , . The downfall was foretold in many ways.

The collapse of the giants helped the younger startups learn their lessons hard. Founders realised that their internal controls, corporate governance practices and, of course, accounts would go under more intense scrutiny. But not many had the wherewithal to change things around.

Many large startups earned the ‘tainted’ tag in the past few months with their founders being chased by investigating agencies. Investors declared court wars and employees were laid off. The blame, in most cases, was put on the lower management.

Some analysts feel the frenetic rush of startups for listing on stock markets has been a major reason behind rampant fudging of numbers or averting transparent practices.

“There’s an unbridled pressure on IPO-bound startup founders and management to show profitability for floating their public issues. At times, they also resort to creative accounts dressing to clear the exit of long-term investors before the draft papers are filed for the IPO,” Pramod added.

As many as 13 new-age tech companies went listed on the bourses in 2024, mopping up INR 29,070 Cr. According to Inc42 data, at the start of 2025.

“It is basically a slowdown exposing the bad actors in the system,” Siddarth Pai, the founding partner and chief financial officer of early stage venture firm 3one4 Capital, told Inc42.

Pai, who is also part of the Executive Council of the Indian Venture Capital Association (IVCA), admitted that when there was free flow of capital in 2021, big and small companies and even the VCs almost ignored good governance and quality checks, and the growth story took over.

“We have reached a point where there is no more funding FOMO (colloquially, the fear of missing out). With ample liquidity in the market, speed was essential. But a slowdown exposes these defects as capital dries up and these issues are impossible to hide then,” he said.

From in 2022 to as BharatPe MD and subsequent legal battle that lasted more than two years to with inflated revenues in 2023 – a close look into tainted startup biggies reveals a pattern of how financial frauds, governance lapses, and inflation metrics led to their downfall, put India’s reputation on global investment map at stake, and further slowed down big-ticket fund-raising.

Who are the people responsible for such a mess? Who are the enablers? Why are such events coming back? As Inc42 looks deeper into the crisis plaguing the industry, there’s better clarity in the pattern.

Take the case of any high-profile ‘tainted’ startup, and there seems to be a common modus operandi for the alleged fraud and even the scapegoats and enablers.

What emerges is a loop — an erring management pressurising the sales team to drive business and pushing the finance team to show growth at any cost (as promised to investors), no matter if it calls for sidestepping controls, inflating revenues, making fake invoices and even money laundering.

As Inc42 tried to seek the pattern, we spotted some common ways of cheating investors by late-stage startups. In most cases, the target was to raise funds either from VCs or from retail investors.

Inflating Revenues, Faking PaymentsRevenue inflation is common among startups that have erred in their corporate governance practices.

In BYJU’S, for instance, its long-time auditor Deloitte refused to sign the FY22 financials and flagged concerns over the way revenue was accounted for even though the edtech major was yet to realise the payments from its students.

The issue snowballed into a big controversy which made BYJU’S change its revenue recognition strategy and that eventually showed up as spiralling losses on its books. “

What is intriguing here is why Deloitte could not spot such glaring revenue inflation tactics earlier,” WealthinIndia founder Sahen Karamchandani said.

Other revenue inflation tactics have come up such as fake vendor payments, which was seen in BharatPe, Zilingo, and GoMechanic. In many cases, inventory on the books of companies is marked as sold and then sold again after either being returned back to the company or after never having been sold in the first place — this is commonly known as round-tripping of inventory, and allows a business to show inflated sales against unmarked inventory goods.

There are also companies who bill vendors and customers who do not even exist, like in the case of GoMechanic or BharatPe. In these cases too, the goal is to inflate sales, show a high gross transaction volume and value, in the hope of raising more funds.

Exaggerating User MetricsFor any consumer-facing startup, metrics like daily active users, monthly downloads, monthly active users are paramount to show that the company is on the right track. The target is to attract fresh investors or convince the existing investors for fresh funding.

A scrutiny of the showed how the short video app claimed to have some 100 Mn users who uploaded 5 Mn videos on the platform. When EY India uncovered the fraud, Trell’s $100 Mn fresh funding round came to a screeching halt.

Inc42 also reported how owned by VerSe Innovation, was allegedly using fake bots as followers to pump up its paid influencers campaign and show user traction.

Syphoning Of Funds And Related Party Transactions“For content-based platforms, including short video companies that raised huge funds during the COVID days, misleading revenue metrics often became the only saviour to show growth,” a former CXO of VerSe said, refusing to be identified.

Money transfers to related entities, mostly subsidiary shell companies, is an oft-reported financial fraud among rogue startups. After raising significant capital by posing as champions of India’s growth story, the surplus sometimes transferred the funds to related or non-related companies that came under the purview of auditors or investors when cash dried up.

A case-in-point is again the country’s biggest edtech elephant BYJU’S. The company is still fighting an extended legal battle with its debtors over diversion of money exceeding $500 Mn to a sham fund house in the US.

In a more recent instance, after its founders Anmol Singh Jaggi and Puneet Singh Jaggi were accused of transferring money to related parties and family members out of the debt they had taken from state-owned agencies for purchase of vehicles.

Making Blunders In Audit, Spotting The ScapegoatOversight of auditing firms, even the Big 4, in conducting due diligence before a fund-raising round or during the audit of financials has often come to the fore after anomalies were spotted in startup books.

“Even reputable auditors like the Big Four – the group of Deloitte, PwC, EY, and KPMG – have failed to highlight these manipulations time and again. It commonly goes unnoticed or is revealed only after a significant delay,” Sahen Karamchandani of Wealthtech India said.

While audit firms conduct checks, their examination may be restricted to what the startup discloses.

Additionally, auditing companies encounter a conflict of interest as they are compensated by the company they review, and in the highly competitive landscape, there’s a subtle motivation to maintain client relationships rather than rigorously challenging their numbers aggressively, others added.

The blame is usually put on the finance team or the CFO when the company’s financial misreporting is highlighted, but it is hard to believe that auditors do so on their own without taking the view of the board or of shareholders.

“It is a misconception that auditors report to the founder alone. They are in fact answerable to shareholders as well,” Pramod of Kayess pointed out.

Ajay Goel, the chief financial officer of BYJU’s, for instance, resigned within six months in 2023 when the company was under scrutiny for accounting fraud and delayed financials. There was a rerun of a similar incident at VerSe Innovation when Sandeep Basu stepped down as CFO shortly before the company filed its FY24 financials, in which Deloitte flagged material lapses.

What Sets Off The Alarm Bell For Auditors?The recurrence of financial irregularities in the startup segment have jolted awake the regulatory authorities which, in turn, have started pulling up the auditors. But what drove the industry to a correction course? It’s the that had set nearly 50,000 people jobless.

The fiasco stirred up huge debates in Parliament as well as outside on what could have gone wrong. The role of auditors – first Deloitte and later BDO MSK & Associates – was perceived to be critical because of the doubts cast on the financial filings by the edtech firm.

The development sensitised the Institute of Chartered Association of India (ICAI) and the Financial Reporting Review Board (FRRB) to raise the guardrails to ward off accounting frauds designed in privately funded, VC-backed, high-growth startups like BYJU’S. The ICAI last December said that on accounting practices by individual auditors of BYJU’s and the statutory body accordingly recommended to the FRRB to take punitive actions on errant auditors. The FRRB is still investigating the between FY21 and FY22.

“There is fear within the auditor circles on the notices now being issued by the ICAI when it comes to lapses. Hence, there are tighter controls in place and large accounting firms would not want to be on the bad side of a statutory body,” Pramod said.

Karamachandani pointed out that while for growth-stage and late-stage startups, having their financials audited by a Big 4 firm has become crucial for convincing the investors for next big-ticket fund-raising or an IPO listing, the problem arises when such frauds are perpetrated in early-stage startups.

“In any early-stage startup, the practices are not usually as transparent since their in-house CAs and finance teams do the job. Any financial misreporting is, therefore, not accounted for in most cases. Moreover, with limited cash flows, early-stage ventures fail to allocate a big budget for auditing, which further complicates the process,” he said.

There is also a growing trend of outsourcing audit checks and forensic audits to consulting and bigger audit firms appointed by shareholders or investors or founders. “Basically accounting isn’t just one more checkbox that any company is eager to tick, rather it should be ingrained into the operations from the very beginning itself,” Pramod said.

Is VC Due Diligence Foolproof?There are myriad consequences of financial frauds or governance issues, but investors suffer the worst of burns. A loss of faith in the founder or the management heralds the onset of downfall for the company. What follows is an endless loop of courtroom wars and boardroom dramas that very soon trigger a blame game between the investors and the founders.

“In such a situation, VC funding is like riding a tiger – you cannot ride it, neither can you afford to fall – the loss is only yours,” Pramod added.

Funding at $3.1 Bn sequentially in the first quarter of 2025, as per Inc42’s Indian Tech Startup Funding Report, Q1 2025.

While conducting due-diligence, which involves checking the financial health of the companies, third-party audits and assessing the legacy of founders, is imperative when investors zero in on a company, the cracks often appear in the post-investment journey when results aren’t delivered as promised.

“The startups that have been caught on the wrong side have been overpromising, under delivering and, worst of all, fudging VC money for personal uses. In the beginning, while the founders got away with it, the VCs have now raised the bar and are in no hurry to just invest because they face pressure from LPs. Once it gets murky, the reputation is tainted not only of the company involved but also of the VCs which banked on it,” a senior partner with a growth-stage fund told Inc42.

Pramod also questioned the due diligence carried out by large or small VC funds during or after the investment journey.

“Unfortunately, neither carries the kind of due diligence that is warranted when this kind of capital risk is involved. Even right now when we see some sort of investment traction towards deeptech startups, VCs are just riding the tide without adequate due diligence measures. The understanding of this model in itself is limited and, hence, for a fund not to bank on a third-party audit or seek professional advice or consulting in such investments would not go down well,” he said.

For smaller firms, the problems are manifold since the budget allotted for DDs, according to industry experts, is too small and hence there are fewer compliance checks. Such inadequacies in the system keep the fate of investors uncertain. But, signs of improvement in the entire process have begun showing up.

The Startup Ecosystem Needs A Clean UpDoubts are inevitable over the success of cleaning up the procedures in an ecosystem of with the count on a steady rise. But the process has started in the world’s third-largest startup economy.

An increasing number of VCs are adapting to heightened scrutiny and industry-best practices like regular discussions with auditors and third-party service providers, asking for source data to validate MIS info, periodic reporting to boards, independent assessment and various other measures. Some of these are carried out independent of the management, according to Pai of 3one4 Capital.

“If there is even a little bit of hesitation on part of the founder when it comes to conducting due diligence reporting, undue haste in closing a round is not considered a healthy sign by the incoming VCs or funds to go ahead with investments. Compromises on data are not taken kindly,” he said.

Pramod believes that the best outcome can be achieved when there is a greater degree of transparency even if there is a lagging growth across a few quarters. “While chasing the numbers, founders are not opening up on such issues before the board or even investors, though there are still scopes of damage control at that point,” he said.

Sometimes the VCs go on consistently backing a founder even if his past ventures have flopped, or there is a history of misadventures. “We have also seen how Adam Neumann, the WeWork CEO in the US, raised significant capital afresh despite taking his last startup to the bankruptcy throes. This phenomenon is not specific to India alone,” a veteran late-stage investor said.

VCs often prefer a celebrity founder who is well connected. This has been a trend observed over the years. This helps them garner media attention and achieve brand recognition through increased visibility. This in turn translates to higher user base and improved earnings.

As Inc42 maps the emerging trends in the risk mitigation practices so far as auditing goes, corporate governance secures the top slot. Good governance is a priority even when the company explores an internal round with participation from the existing investors.

“There are legitimate concerns now being raised by the investors when it comes to related party transactions that often show up on company books,” Pai said.

Measures like tolerating the execution risks, market failures are essential metrics that VCs today consider before pumping money into a company. This is a sharp drift from the growth-at-all-costs stand which was a norm till recently. Third-party audits too have started conveying if any information is diluted on purpose by the founder or the management.

Pai listed three rules for the VC playbook in the wake of governance lapses and financial frauds.

“VCs must take note of these three aspects before making the final move towards investment,” he said. “First, check if the founder is hesitating in providing information. Second, try to assess if there’s undue pressure to close financing without honouring data requests. And, third, note if the management is gatekeeping information or refusing to allow third parties to speak to customers or the junior management.”

While the measures are being amped up to do a systemic clean-up of the ecosystem, the recent controversies have made the financial disclosures of even big startups doubtful.

“Regulatory bodies like SEBI and the RBI are starting to intensify their investigations, yet enforcement measures remain insufficient. Without the establishment of stronger governance, thorough audits, and independent review in the startup ecosystem, the relentless push to achieve unrealistic growth stories will persist in fostering unethical accounting behaviours, even under the scrutiny of leading auditors,” Karamachandani said.

The spate of unethical practices and their impact certainly clouds the credibility of Indian startup founders, but there are some green shoots emerging in the ecosystem. Peak XV, formerly Sequoia India, for instance, has implemented stronger internal audit practices for its portfolio. Firms like Accel and Elevation Capital are actively coaching founders on ethical scaling and operational transparency. Some early-stage startups are voluntarily publishing governance whitepapers as part of pitch decks.

For the ecosystem to remain relevant and sustainable, India must not haste towards building 100 unicorns every year, rather build startups that can last 100 years.

Edited By Kumar Chatterjee

The post appeared first on .

You may also like

Rajasthan: Police successfully diffuses suspicious object recovered in Jaisalmer

Steven Gerrard 'loses massive cash sum' as Liverpool hero's big-money investment goes bad

Jyothy Labs' Q4 net profit dips 2.4 pc as rising costs offset revenue growth

Just one setting and your Wi-Fi speed will become superfast, follow this easy trick

'If Thommo don't get ya, Lillee surely must': DGMO Ghai explains India's robust air defence citing Ashes example