Fintechs have long been viewed as giant killers, aiming to disrupt all major components of the financial world, be it payments, lending, insurance, stock broking or wealth management. They are a catch-all for a new wave of transformative technologies and financial inclusion with enormous ripple effects. But rarely do we find one to engage in witty wordplay or burst into poetic storytelling to promote its core mission.

India’s biggest stockbroker, , a startup barely a decade old but serving over 1.3 crore active investors (per NSE) across the country’s bourses, did just that in January this year. Its impact, as usual, is far-reaching yet simple. Since its launch in 2016, the customer-first fintech has demystified capital market investments and made them easy, fast and transparent. Its commission-free model has helped it tap into young, tech-savvy investors keen to explore the world of mutual funds and stock markets.

But behind this success lies a series of challenges that tested the platform’s ability to stay competitive, grow exponentially and navigate an increasingly crowded and regulated market.

Consider this. India had 5.6 Cr (56 Mn) unique mutual fund investors by the end of December 2024, according to the . In contrast, the US had approximately in 2024 across 71 Mn households or 53.7% of all U.S. households.

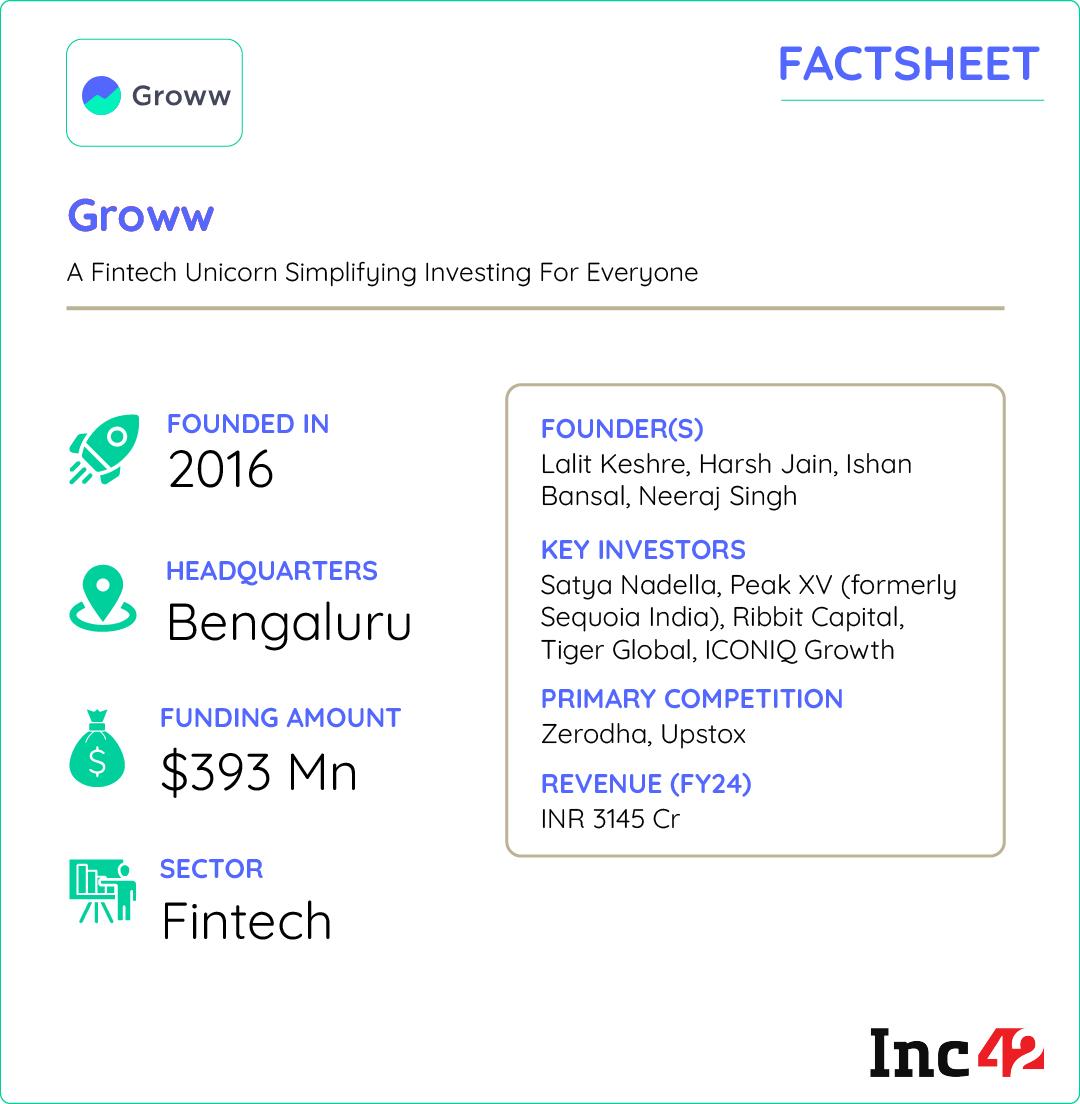

Additionally, financial literacy is just 24%, per the National Institute of Securities Markets (NISM) survey. Given these ground realities even now, helping small investors build wealth by betting on India’s economic growth was no easy task when Groww was set up by four senior executives from Flipkart — Lalit Keshre, Harsh Jain, Neeraj Singh and Ishan Bansal.

Keshre, an electrical engineer from IIT-Bombay, had already ventured into entrepreneurship and launched an edtech startup, Eduflix, in 2011. Jain, an alumnus of IIT-Delhi and the UCLA Anderson School of Management, dabbled in storytelling with his short-lived startup Runjhun Stories in 2008.

Singh, with a solid decade of engineering expertise and Ishan Bansal, a CFA and chartered accountant with extensive exposure to corporate development and M&A, completed the team.

While at Flipkart, Keshre and the other three saw firsthand how technology and a sharp focus on the customer experience transformed e-commerce in India. However, the financial services space was still opaque due to complex operations and limited access to information. Although 60% of household savings in India were held in financial assets then, just about 1.3% of the population engaged in the stock market compared to approximately 27% of the U.S. population investing in equities.

As for mutual funds, there was a glaring gap. Of nearly 200 Mn Indians with investable incomes, only 20 Mn actively invested in those during 2016-2018. Undoubtedly, there was a huge opportunity to simplify how Indians buy financial products.

The collective vision was clear. The four founders wanted to democratise investing for every Indian. They built a full-stack financial services platform focussing on mutual funds, stocks, futures, options, initial public offerings (IPOs) and wealth management. Since 2022, Groww is also offering instant credit to eligible customers and building a loan book worth INR 1K Cr.

Groww’s Journey: The Opportunity & The Primary Building BlocksFinancial services in India have always been sold, posing high entry barriers and confusing processes. We believed this could be solved with the principles of internet companies — simple, user-centric products, transparency and choice.

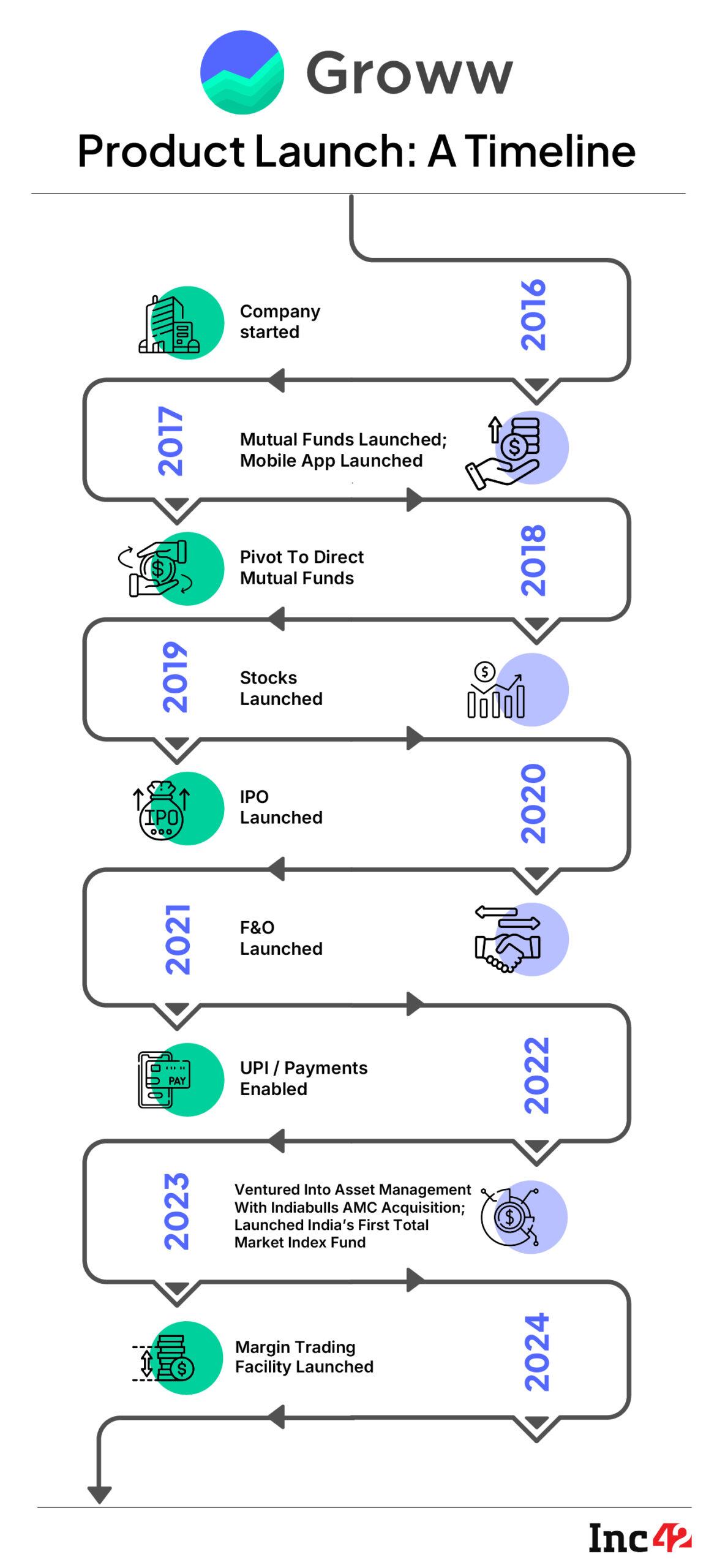

Groww was initially launched as a direct mutual fund distributor in 2016. The timing was, indeed, fortuitous. The country’s growing digital finance ecosystem, powered by UPI and Aadhaar-based e-KYC, made customer onboarding faster and digital payments seamless. Again, affordable smartphones and internet access transformed financial inclusion. It was a golden opportunity to onboard the next 180 Mn investors.

However 2020 was a turning point for Groww. It marked the beginning of an era when people became more financially aware. Before that, concepts around capital markets were overwhelming and far from everyday conversations. Post-2020, personal finance became a topic of interest, supported by educational content that simplified industry jargon.

As a result, the fintech startup looked at three key areas.

- Stock trading, including short- and long-term trading, exchange-traded funds or ETFs, digital gold, futures and options (F&O).

- Then, there were investments, including direct and indirect/regular mutual funds.

- Third is wealth management, involving family offices and high-net-worth individuals (HNWIs).

Each segment had its challenges. Stock trading required deep engagement with retail investors, and wealth management meant building relationships with HNWIs.

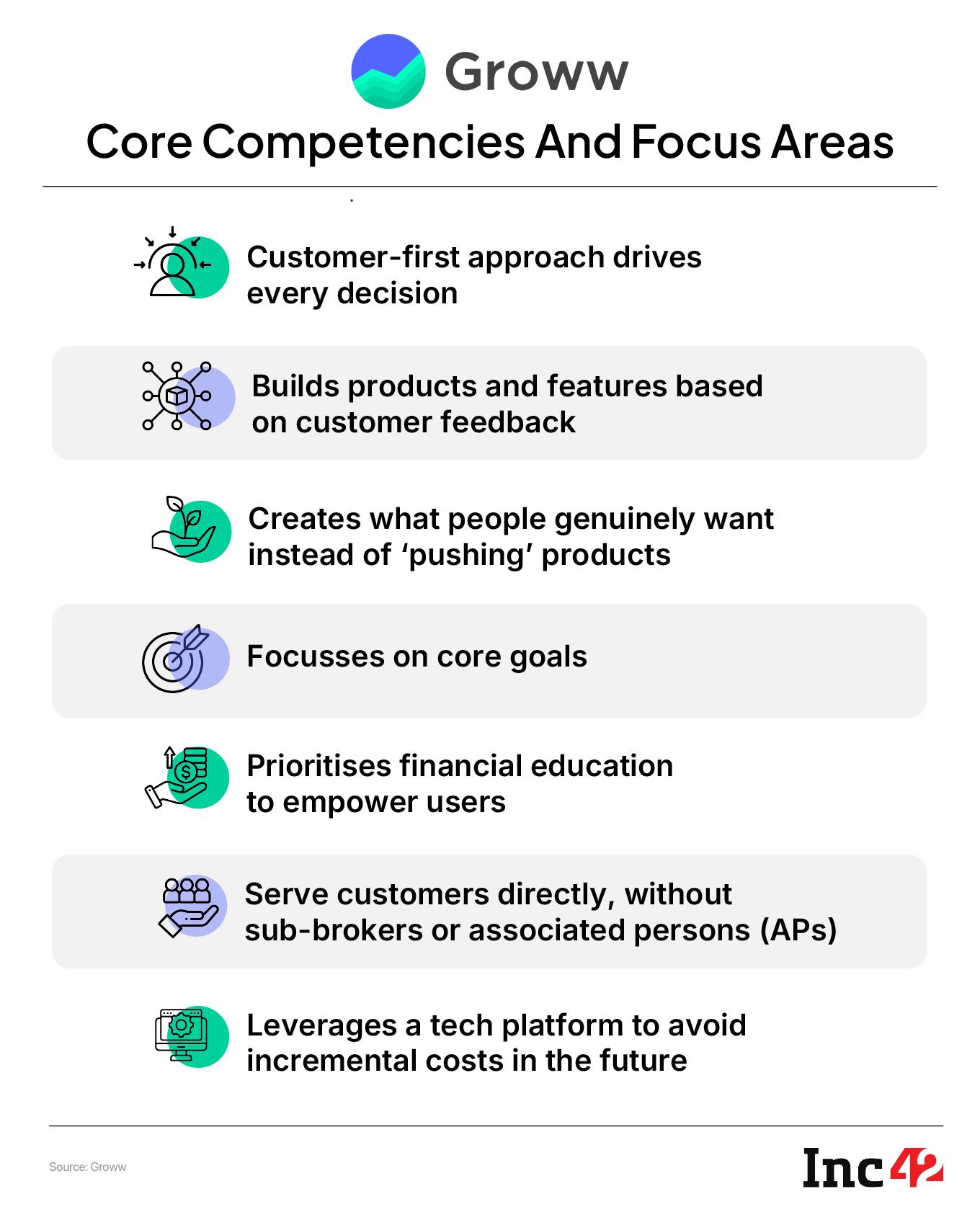

Mutual funds, on the other hand, ensured a simpler entry into financial markets. However, most platforms offered regular mutual funds, where intermediaries earned commissions from retail investors. Groww founders decided on a different route and opted for direct mutual funds so that people could buy MFs from fund houses/asset management companies (AMCs) and skip those fees.

Investing happens where people engage. Banking apps cover routine transactions and a few investment options, but pure-play investment apps far exceed that and see regular user engagement. If a company can leverage that engagement and build trust, it can later expand into other financial services.

Another strategic decision was to focus exclusively on direct mutual funds during the first four years, although this model generated no commission revenue. The goal was to make mutual fund investments user-friendly and cost-effective, an approach that was rare at the time.

Most platforms offered mutual funds as a side product but prioritised stock trading and derivatives. But Groww wanted to be different when it built the right investment product for customers at large.

Despite India’s growing interest in investing, a big chunk of the population was not familiar with basic financial concepts. Others relied on advice from family, friends, neighbourhood brokers or casual conversations when choosing stocks and mutual funds.

Groww’s goal of simplifying investing into a more structured, informed process was praiseworthy. But it also meant shouldering the responsibility of educating a largely untapped audience. It was no small task, particularly when reaching potential investors in smaller cities and towns. So, the platform started building financial awareness through blogs, videos, e-books and market updates, gaining massive traction in the process.

The fintech’s initial strategies paid off. Groww turned a profit in FY21 and was valued at $3 Bn in October 2021 when it raised a $251 Mn Series E funding round led by ICONIQ Growth. It has secured $393 Mn from investors such as ICONIQ Growth, Alkeon, Sequoia Capital India (now Peak XV), Ribbit Capital and Tiger Global. The fintech giant is now gearing up for an IPO, with a projected valuation of $6 Bn-8 Bn.

Groww entered a crowded market as the 41st investment app on the Google Play Store. Competitors like Zerodha, ET Money, Paytm Money and Upstox already offered more diversified investment services and reaped the fruits of better brand recognition. Hence, the challenge was to stand out from the rest by constantly refining its strategies and products.

The founding team spent a year studying the requirements of potential customers. They surveyed moviegoers, answered finance-related queries on Quora and created WhatsApp groups to gather insights. A consistent theme emerged: Capital market investing was perceived as complex, opaque and dominated by intermediaries.

Groww’s solution is straightforward and bold — a do-it-yourself approach instead of navigating investments via intermediaries. Its website and app are designed with the beginner in mind with insights into stock performances and market updates being presented in easy-to-understand formats, helping users make informed decisions even without financial knowledge.

Then there are features like Discover — which allows users to filter mutual funds based on user preferences.

By offering direct mutual funds, Groww helped users do away with the commissions typically charged by brokers. But as the platform grew, it enabled customers to import their regular mutual funds which were managed externally. This helped customers get a holistic view of all their mutual fund investments. particularly for users with existing portfolios or those who preferred convenience. In these cases, the mutual fund distributor earned a commission (a small percentage of the total investment value) from AMCs. However, Groww did not charge any brokerage fee or demat account opening fee from investors.

The platform also provides a brokerage calculator to make investing pretty simple.

Given these cutting-edge advantages and customer-centric approach, by the end of 2020, it became India’s largest mutual fund distributor and clinched its place as India’s second-youngest fintech unicorn.

Over the years, Groww has launched several initiatives to deepen its customer connections. Some of these include:

- Customer outreach for better engagement: Groww Digest, a daily newsletter written by the founders, now reaches 1.5 Cr readers, simplifying financial literacy.

- ProdX for real-time feedback and fast resolution: Every week, Groww hosts ProdX, a programme where real users test new features and provide immediate feedback to the product team. This allows the team to spot and address issues swiftly, rolling out updates and improvements without delay.

- Project Bezos for better insights into pain points: This programme encourages employees from all departments to work as customer support agents for several days, helping them understand customer pain points and building empathy.

Diversifying Beyond Mutual Funds For Sustainable Growth

Diversifying Beyond Mutual Funds For Sustainable Growth With a strong MF investor base of , the next logical step was monetisation at scale. But the challenge lay in doing so without hurting the core elements that made the platform successful — affordability and ease of access. It meant the startup had to balance zero-commission investments and sustainable growth.

In March 2020, Groww beta-launched stock trading and rolled out the entire service suite by June. Although delivery trading (buying and holding stock for more than a day with the intent of long-term investment as opposed to intraday trading) is free on investment platforms, users have to pay annual maintenance charges on their demat accounts. But Groww flipped this business model and introduced a per-transaction fee rather than imposing a fixed yearly charge.

The reason? Many investors trade infrequently or may remain inactive for months, especially when markets are choppy or when they crash. But under the annual fee model, they will still incur charges. In contrast, Groww’s pay-per-transaction model means investors need to pay only when they trade, thus syncing costs with trading activities.

Another critical factor in stock trading is the cost structure. Even without brokerage fees, government-mandated charges such as GST and capital gains taxes weigh on stock transactions, and frequent trading can erode returns due to these cumulative costs. Therefore, Groww has positioned itself as a platform for long-term investors, encouraging people to buy and hold rather than engage in short-term speculations.

This approach has differentiated Groww from its competitors and helped build an investing mindset among retail users.

During 2020 and 2021, Groww broadened its portfolio, adding new investment options such as ETFs, intraday trading and IPOs. It also explored fixed deposits (FDs) in 2021 but did not see much adoption. A typical Groww user was more keen on riskier investments and bigger returns, especially as the stock market performed well.

However, FDs remain a preferred option for many Indians—holding over ₹200 lakh crore in bank deposits as of 2024—and with rising digital adoption, the ecosystem around such traditional products is poised for significant evolution.

Additionally, Groww completed its acquisition of the mutual fund business of Indiabulls Housing Finance (IBHFL) for INR 175 Cr in 2023

The acquisition allows Groww to launch and manage its mutual fund schemes, similar to leading players like Kotak. The latter also obtained an AMC licence from SEBI around the same time to strengthen its portfolio and investment offerings.

Groww ventured into U.S. stocks but eventually phased out the service, citing operational challenges and issues with user experience. Unlike domestic stock trading, where opening a demat account is quick and often zero-balance, investing in U.S. equities from India involves several additional steps, including complex documentation and compliance.

Although, if the RBI simplifies the process in the future, Groww might consider relaunching.

Today, more than 1.5 Cr users across 900+ cities and 19,004 pin codes (out of 19,252) are using Groww. Most of them are under 40, are digitally savvy, have a better risk appetite and value the ease of managing investments via mobile.

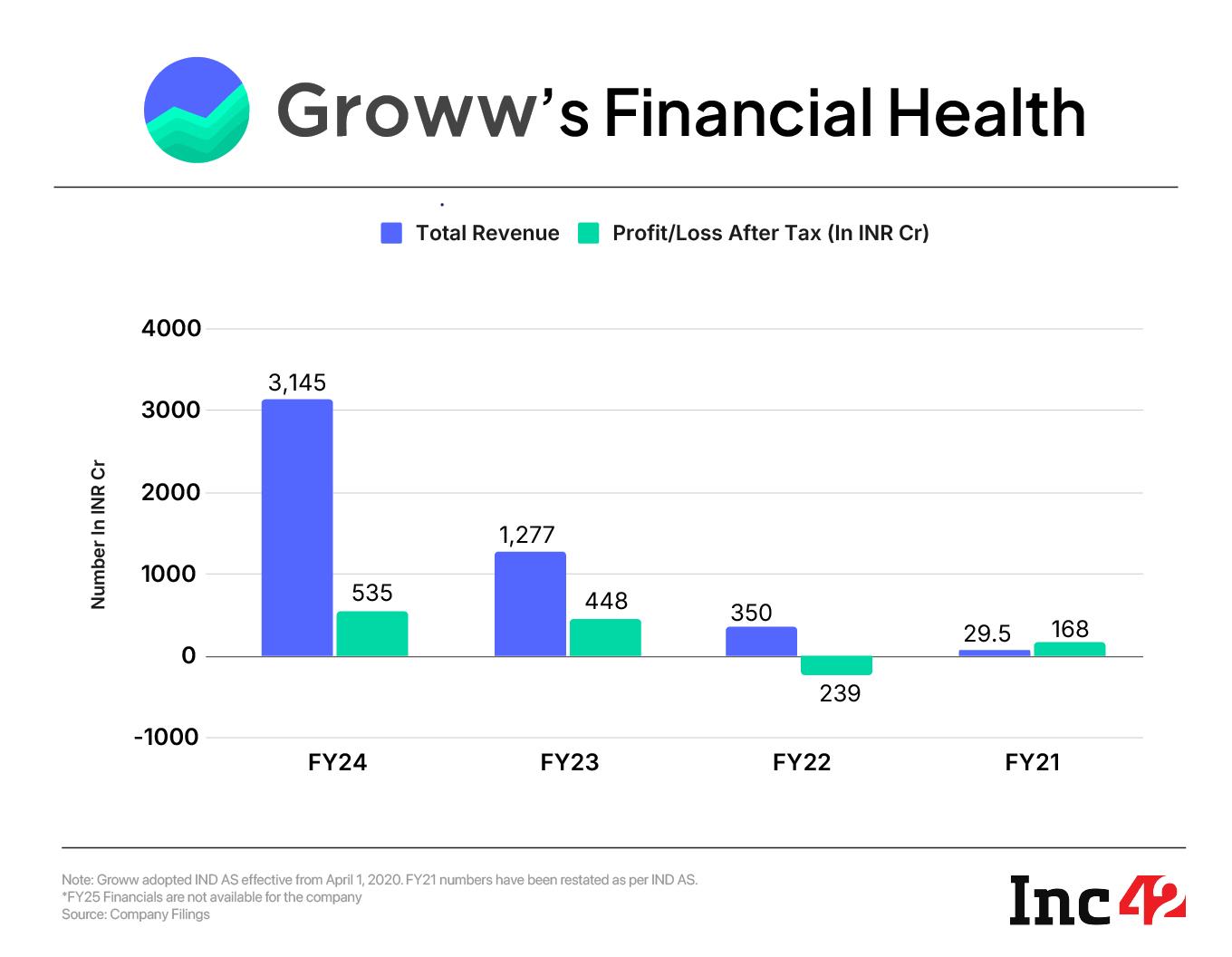

Groww’s rapid expansion has significantly bolstered its revenue while maintaining a lean, cost-efficient structure. The fintech hit the profit button in FY21, reporting a net profit of INR 2.72 Cr on revenue of INR 40.4 Cr.

By FY24, it had scaled dramatically, with revenue climbing to INR 3,145 Cr from INR 1,435 Cr in the previous fiscal year, reflecting a 119% growth. Operational profitability surged to INR 535 Cr, while the company paid INR 1,300 Cr in taxes following its decision to relocate its to India. [The company’s FY25 financials are yet to be disclosed.]

Despite its service diversification, Groww has retained its dominance in the mutual fund segment with access to more than 5K mutual funds through direct plans that can save customers up to 1.5% in commissions. Among the 68 Mn new SIPs initiated across the country in 2024, more than 16 Mn, or 23.5%, came through Groww, making it the largest player.

Since 2024, Groww has maintained a 23-26% market share regarding new demat accounts. The platform has built its reputation by prioritising simple, long-term investment strategies over high-frequency trading. While competitors like Zerodha, Upstox and Dhan dominate trading and F&O segments, Groww has set itself apart by focussing on retail investors looking for sustainable growth.

It is now gearing up for a significant milestone: An. Reports suggest the fintech aims to raise approximately $700 Mn at a $6-8 Bn valuation. The public offering is poised to infuse capital for expansion and strengthen its market position.

In addition, it is exploring new product offerings to build its moat. Insurance is a key focus area, as the platform aims to tap into its large, engaged user base for cross-selling opportunities.

But all said and done, the platform may focus on its AMC business and build a long-term strategy for a substantial slice of India’s rapidly expanding asset management market, especially within the mutual fund sector. As of March 31, 2025, the .

Could building a fund house be another game-changer for Groww? If that happens, will there be a conflict of interest as it works with thousands of regular and direct mutual funds?

Although regulatory safeguards make such a conflict unlikely. SEBI imposes strict guidelines that require all changes on Groww’s platform to be approved in advance. Additionally, the mutual funds listed are ranked using an algorithm, eliminating human bias.

Currently, Groww is still relatively new to active mutual fund distribution and continues to focus primarily on its passive mutual fund business, an area where it has developed substantial expertise. The company is expected to take a gradual, cautious approach as it builds its asset management arm.

Despite many changes, Groww’s core strategy remains constant — prioritising responsible investing over high-risk trading. For instance, it entered futures and options much later than its competitors, launching in late 2021 or early 2022. But from Day 1, it has proceeded cautiously, as SEBI data shows that many traders, especially those in intraday and derivatives markets, ultimately incur losses.

As Groww moves towards its IPO and expands its user base and product portfolio, its ability to remain relevant and competitive will depend on its adaptability. So far, the platform’s success reflects its thorough understanding of the market’s need for simplicity and transparency. As the digital investment space evolves, Groww must stay nimble, balancing user education, long-term investing and customer-first strategy to remain at the forefront of India’s wealthtech revolution.

[Edited by Sanghamitra Mandal]

The post appeared first on .

You may also like

3 Doors Down frontman Brad Arnold shares stage 4 cancer diagnosis in emotional video

Mumbai News: PIL Filed In Bombay HC To Preserve Savarkar Sadan Amid Concerns Over Redevelopment And Demolition

Punjab National Bank Q4 Net Profit Jumps 52% To ₹4,567 Crore In FY25

Navi Mumbai Records Over 50 mm Rainfall In 24 Hours; Tree Falls, Fire Calls Reported, No Casualties

Bombay HC Directs Maharashtra Govt To Hear Slum Dwellers Facing Eviction From Sanjay Gandhi National Park