India’s quick commerce economy has a new darling. Quick fashion platforms such as Slikk, Blip, KNOT, NEWME are building up momentum and banking on VC funding to disrupt Flipkart-owned Myntra and Reliance-owned AJIO.

Slikk’s $10 Mn funding this past week feels like the beginning. All In Capital-backed KNOT is also close to its first major round, while Accel-backed NEWME is scaling up its own 30-minute delivery vertical to take on the new players.

Are these platforms a passing fad — just like the apparel they sell — or is there real substance behind this trend? Let’s dive in, but after a look at the top stories from our newsroom this week:

- Amid the exit of Gaurav Munjal and Roman Saini from Unacademy, nobody within the inner circles of the two founders seems to be surprised. Here’s the inside story on what happened at Unacademy

- Microdramas are soap operas broken into short minute-long episodes with cliffhanger endings that keep the viewer swiping, and this craze is soon set to sweep across Indian social media. Here’s an early look at the next wave in OTT

- Bira 91 has battled deep financial distress and business disruption since early 2024 after being compelled to change its registered corporate name. Here’s what happened at the craft beer maker

Do we really need a dedicated app to get clothes delivered in 30 minutes? Like the early days of 10-minute delivery, the question has come up again with the quick fashion wave.

According to Blip cofounder Ansh Agarwal, because most horizontal quick commerce platforms had tailored their distribution and supply chain for essentials.

“Groceries and fashion are fundamentally different, with well established mental models for consumers. No one will think of Myntra or Nykaa when they are shopping for food items. This gives fashion-focussed marketplaces like ours a clear edge,” Agarwal told Inc42.

Blip’s launch in October 2024 has been followed by a flurry of activity. Bengaluru-based Slikk soon began making 30-minute deliveries, while Myntra launched M-Now to add to the competition in the quick fashion space. Reliance Retail is applying the model to AJIO through dark stores and its existing store network, while NEWME, which wanted to become India’s answer to Shein, jumped on to the quick fashion bandwagon last year.

The startup began with 90-minute deliveries in Delhi, and then launched NEWME Zip to offer over 1,500 styles in under 60 minutes across Bengaluru.

is supported by a network of dark stores, zonal hubs and a real-time inventory engine to keep the right styles stocked near high-demand areas. In early trials, the startup claims it has been able to consistently deliver in under 30 minutes, even during peak traffic hours.

“In Delhi, quick commerce orders now account for around 20% of total daily orders. Bengaluru’s pilot is currently around 5-6%, with plans to scale it up to 20-25% soon,” according to founder Sumit Jasoria.

VCs Show The AppetiteSlikk raised $10 Mn in its Series A round this past week, led by Zepto backer Nexus Venture Partners and participation from Lightspeed.

The startup said it will diversify into fashion-adjacent lifestyle categories such as beauty and personal care (BPC), footwear, accessories, and wearables and enter Delhi NCR and Mumbai. Besides D2C brands such as Snitch, The Souled Store, Freakins, Uptownie, Off Duty, Bonkers and Bewakoof, Slikk aims to onboard more than 500 brands by December.

The new infusion will also enable Slikk to test out its plans for instant returns, which is likely to increase the delivery cost to a certain extent. As of October last year, the company’s sales had peaked at 8K orders per month. It’s not clear how much this has grown in the months since then.

Slikk’s round might soon be followed by another quick fashion startup KNOT, which is in talks , as we reported this week. Interestingly, KNOT went by the name Slick (we know) and was building a social network platform before the pivot to quick fashion.

Does It Make Sense?The rush does not automatically mean that Indians will change the way they buy clothes and lifestyle accessories online. A lot of this is about testing the market to see what works and which categories stick.

Demand for luxury and designer wear under the 30-minute model may not be great, but one could see everyday wear becoming a staple for these platforms. Socks, underwear, gymwear or everyday office wear might be the main draw here, particularly if the audience is in cities like Bengaluru, Delhi and Mumbai.

But do investors pouring in millions of dollars justify this need given the relatively niche market? Plus, isn’t this something that established players are already solving? And wouldn’t scaling this up meaningfully require millions of dollars in investment — as it did for Zepto or Blinkit or Instamart?

Even as founders in this space agree that shopping for groceries and fashion is not the same, there is a reticence in accepting that the quick commerce use case — primarily built around low-value essentials — is yet to be tested for large value purchases, especially when we talk about premium brands, where the margins are highest and where the reliance on discounts is lower.

For instance, in September 2024, Slikk founder Gulati told us that average order value (AOV) was around INR 1,800, helping net INR 550-600 per order. Pushing this beyond this mark will require a lot of intervention on the supply chain side. This is arguably why even at their scale, the likes of Blinkit or Instamart do not offer a large number of SKUs in the fashion category.

Newer apps also have to create demand for premium brands and products, while also bringing in the typical accoutrements of fashion marketing such as influencer-led selling, video commerce and more into play.

Incidentally, the new quick fashion wave coincides with the AI-assisted shopping wave. — powered by user selfies — is betting that hyper-personalisation will win the fashion game. Will AI-driven quick fashion become the next big hype?

Industry insiders are not so optimistic that a dedicated fashion platform will be the answer. If AOV is the answer, then the obvious advantage is with Blinkit, Zepto and Instamart. These companies are ahead of the curve when it comes to high AOV than quick fashion platforms. They have spent billions towards the habit creation that has driven quick commerce forward. They have invested millions into supply chains for fashion and electronics.

The Blinkit Way Or Dunzo Way?So when we think about this quick fashion rush, we cannot help but think about the hyperlocal wave of 2015 — not just because of the snappy names of these startups. At that time, everyone thought the likes of Dunzo would replace ecommerce giants and become the new way of quick shopping.

But the quick commerce game which has rocked ecommerce marketplaces was won by Blinkit, Zepto, Instamart and the likes — not by Dunzo.

Now with quick fashion becoming a thing — the question is are these platforms just investor-backed acquisition plays that will eventually be snapped up by larger platforms and integrated into revenue machines?

Quick fashion also does not align with the sustainable or slow fashion movement that’s slowly seeping into the mainstream. More and more consumers are becoming aware of the waste problem created by fast fashion brands, and as the climate crisis worsens, government regulations will look to target this model of production.

VCs seem to be enjoying the ride and no vertical is safe from the instant delivery wave. The next big thing in quick commerce — after quick fashion — could very well be .

Sunday Roundup: Funding, Deals & More

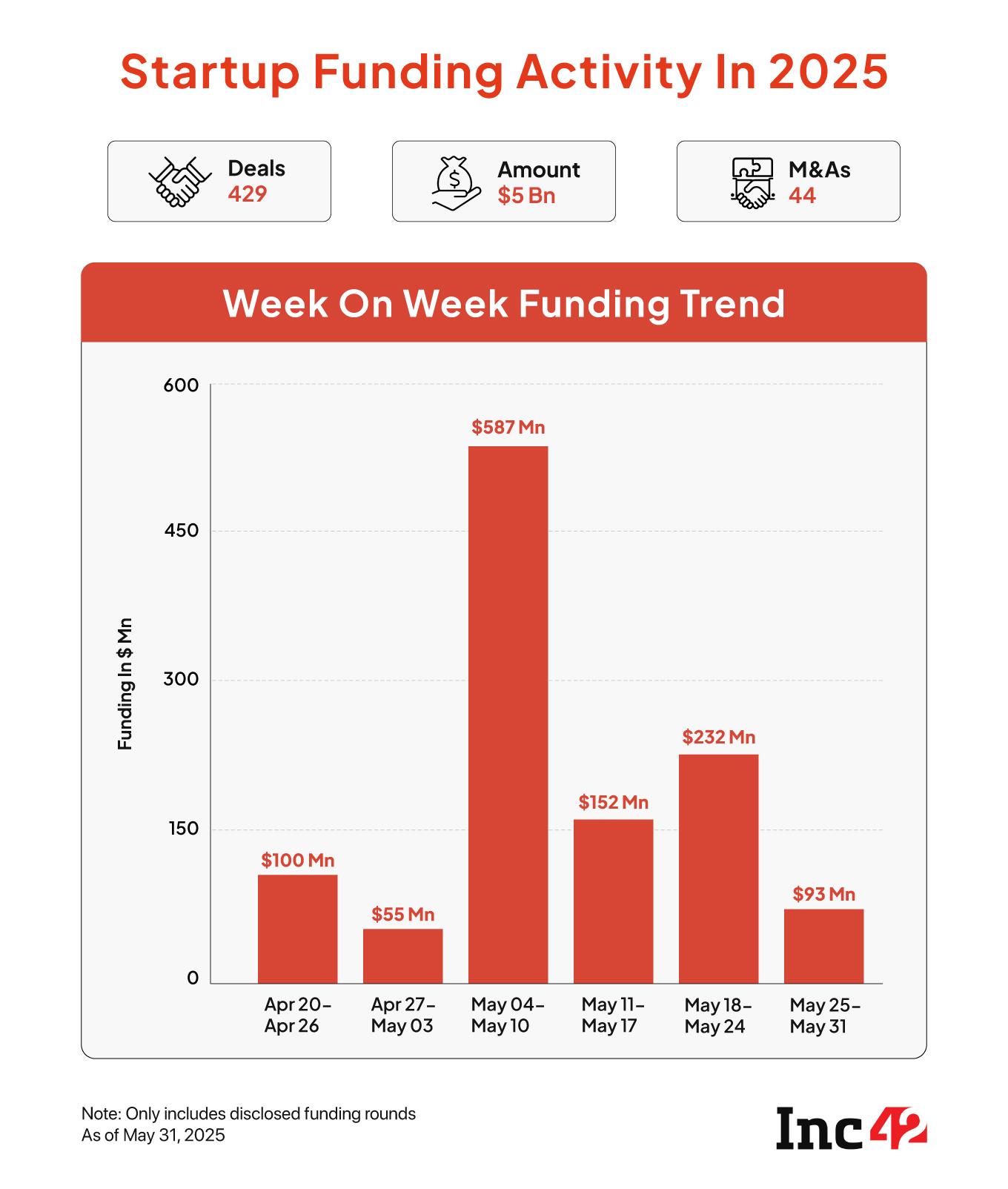

- It was a slow week for startup funding in India with a mere 15 deals recorded and a meagre $93 Mn being raised cumulatively

- The deals this week included food giant Nestlé acquiring a minority stake in homegrown D2C pet care startup Drools, which took the company into the unicorn club

- The fintech major will pay approximately INR 1,245 Cr (around $150 Mn) in taxes to the Indian government as part of its reverse flip to the country, according to sources

- Jio Financial Services and BlackRock’s asset management joint venture has been given the green light by SEBI, giving JFS the big push it needed on the AMC front

- Founder Ritesh Agarwal has sought suggestions from the public for the name and rebranding of the company’s parent entity Oravel Stays Limited as it prepares for an IPO

The post appeared first on .

You may also like

Greta Thunberg joins forces with Game of Thrones icon to 'break Israeli blockade'

Kartik Aaryan, Ananya Panday-starrer 'Tu Meri Main Tera Main Tera Tu Meri' sets its release date

MP: Bajrang Dal & VHP inspect coaching and gyms centres to check 'love jihad' cases

Phil Collins' 10 most streamed songs - and it's not 'Another Day in Paradise' at the top

'Enchanting' BBC period drama based on beloved novel hailed 'masterpiece'