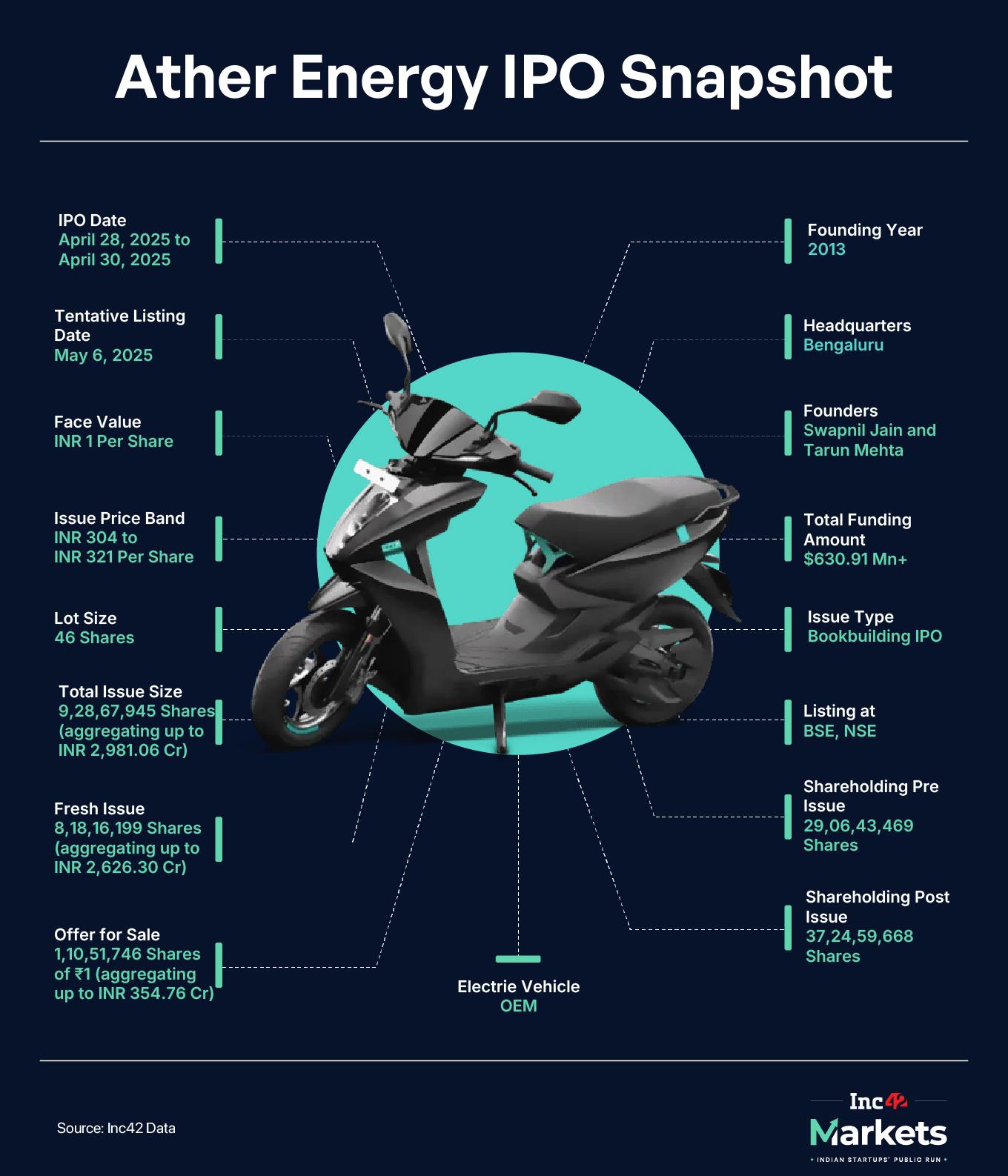

After months of waiting, it’s finally here. Ather Energy will be the first mainboard IPO for FY26, and the first for the year from the startup ecosystem, joining our list of new-age tech stocks.

The excitement around IPOs has been tempered to some extent by the ongoing global economic policy back-and-forth over tariffs and imports and exports, but Ather has already waited too long. In the time between getting approval from SEBI way back in December to now, Ather has learnt some key lessons from the Indian EV market.

The fact that rival Ola Electric has had its share of problems was a sign for Ather to get everything in place for the IPO, which opens tomorrow morning. Ola Electric went for an IPO six years after its launch in 2018; Ather Energy has taken twice that time. Patience was never a problem for Ather in that sense.

It also waited nearly five months for the listing after getting the go-ahead, but now the Ather story has for investors.

When we , the biggest challenge we saw was the company’s slow sales growth. But now, some of those concerns have been allayed with doubts over the true count of sales and registrations for Ola Electric. Ather’s growth numbers seem relatively stable in comparison to Ola’s spiky record.

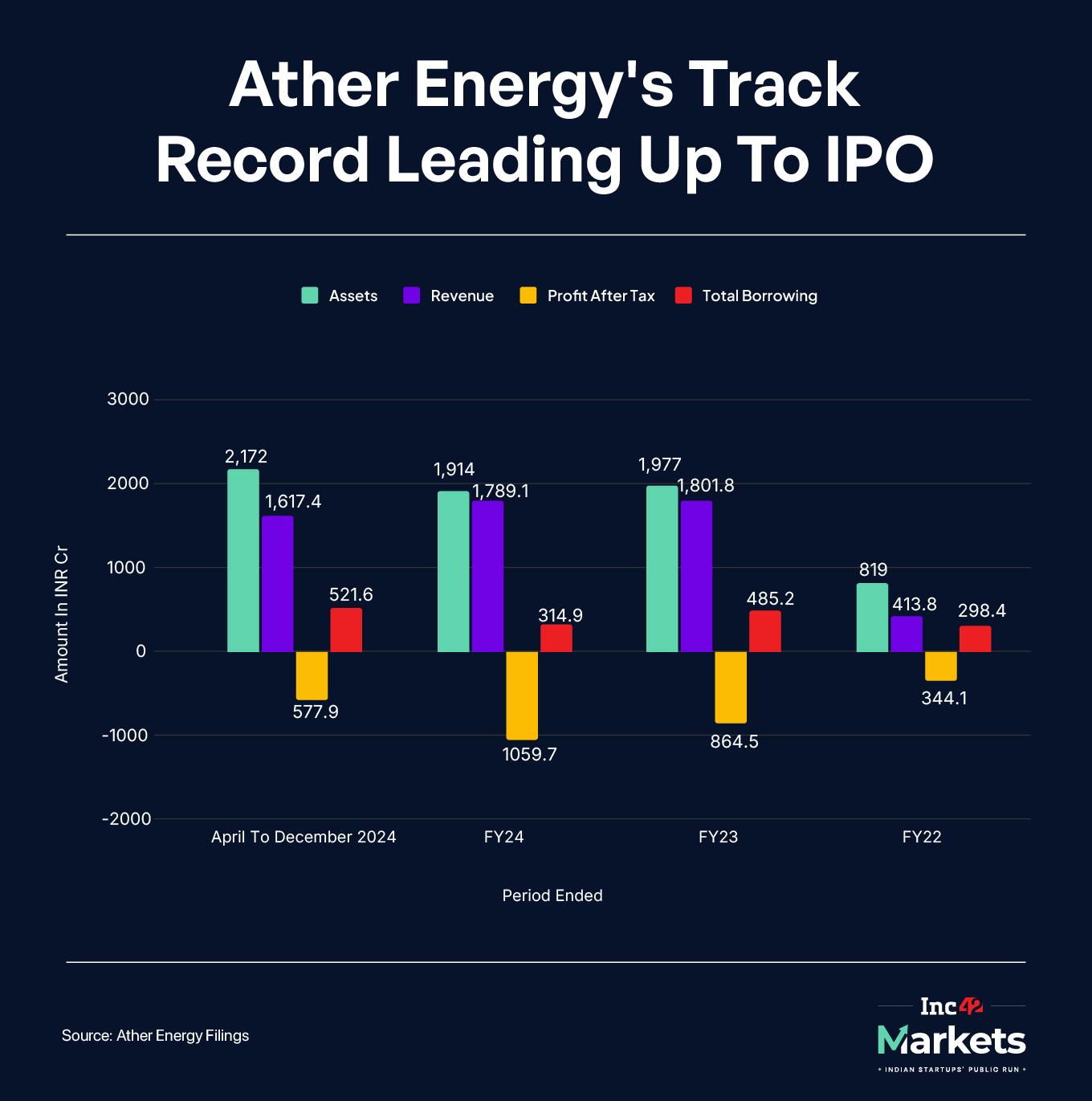

Profitability has also improved, even as Ola Electric’s consolidated net loss widened 50% to INR 564 Cr in the third quarter of the fiscal year 2024-25 (Q3 FY25) from INR 376 Cr in the year-ago quarter, hurt by lower revenue.

According to an Axis Capital report this week, the company has focused on improving gross margins by reducing the bill of materials (BOM) cost of scooters through strategic investments in R&D capabilities, such as key components and technologies.

Designing components in-house has led to improved cost structures such that in April 2024, the company’s Ather Rizta family scooter series had 7% lower average BOM cost than the other Ather 450 series.

As a result of this change, adjusted gross margin more than doubled to 19% in 9MFY25 from 9% in 9MFY24.

Revenue from operations has grown 329% between March 2022 and March 2024, and a further 28% from December 2023 to December 2024. Losses for the first nine months of FY25 have come down by nearly 35% on a YoY basis to INR 577 Cr from INR 776 Cr. Vehicle sales have grown 45% YoY in 9M FY25.

Ather’s updated financials in the red herring prospectus this last week make for much better reading than its previous set of disclosures in the DRHP (circa September 2024), which were limited to FY24 financials.

One cannot say how much of this focus has been sharpened by Ola Electric’s listing in August last year, when Ather Energy would have got an even more clearer picture of its rival’s sales, operations and executional challenges.

Ather Energy Clears Post-IPO PathWhile Ola Electric recently announced a big push for its battery production business, Ather will soon transition to the Lithium Iron Phosphate or LFP-based battery packs, which are generally cheaper than batteries with nickel-based chemistries, after beginning trials in December 2024.

The company is in the process of seeding its Grid 3.0 network of fast-charging infrastructure which is expected to play a role in further reducing the BOM cost of the fast chargers.

But just like Ola Electric, Ather is planning to expand its product portfolio with a new scooter platform called EL and the Zenith motorcycle platform. While Ola Electric claims to be close to delivering its first set of motorcycles, Ather is likely to adopt a significantly slower development strategy.

The EL platform, a more cost-effective scooter, is expected to be the third model out of Ather’s stables, tailored for the affordable segment. The Zenith platform will have multiple models ranging from 125 cc to 300 cc segments.

And customer service has been a sore point in the electric two-wheeler space. Ather plans to expand and deepen its service and experience store network in India, but it plans to have many more service centres than experience stores. The company’s long-term strategy is also evident from this move. Besides this, Ather is looking at this on-ground presence to create strong brand recall.

But, There Are RisksAside from the batteries produced internally, the company depends on its suppliers for all other components necessary for assembling its E2Ws in-house.

This is a potential weak link in Ather’s manufacturing chain. The company has South Korea’s LG and India’s Amara Raja Advanced Cell Technologies as partners, but the latter through a non-binding MoU in a non-exclusive arrangement. This is not exactly the most secure deal at the moment.

For Ather, securing more key suppliers will be critical to avoid disruptions in business operations. It also needs to diversify suppliers in light of global tensions, government regulations or policies against imports or exports and trade wars around the world.

These are equally challenging for other OEMs, but Ola Electric is going for a full-stack approach, which might better protect it in the long run. Will Ather also be compelled to move to an in-house solution, particularly for the battery packs?

Capacity utilisation is another challenge for Ather Electric. The Hosur factory in Tamil Nadu currently utilises 39% of its full capacity for two-wheeler assembly and 41% for battery pack manufacturing. Even as it has not fully capitalised on the potential economies of scale, Ather is moving ahead with a new factory from May 2025, soon after its IPO.

Is the company moving too fast, or is this part of a diversification move as the new factory will be located in Maharashtra? However, the twin manufacturing facilities could be vital for scaling up the two new platforms being introduced over the next few years.

Will Ather Energy IPO Rev Up?Given that this is the first IPO from the startup ecosystem, a lot of eyes will naturally be on Ather over the next couple of weeks. The tainted experience of Ola Electric in the stock markets will not help soothe any frayed nerves in the investor base.

The regulatory trouble for Ola Electric has left a bad taste in the mouths of retail investors, which has tarnished the image of EV startups as well. There’s a lot of complexity around EV subsidies which affects sales and revenues of EV companies, which became more clear once Ola Electric went public.

This does increase the scrutiny on Ather Energy in the public markets, despite the fact that Ather has continuously spoken about its long-term strategic investments in its storytelling for the IPO, rather than focussing on growth itself.

But the company’s fundamentals have certainly improved since its last disclosures and this could be some reason for optimism among investors. Ather raised INR 1,340.03 Cr from anchor investors before the IPO, which is certainly a confidence booster for the market at large.

Incidentally, Ola Electric’s Q4 results will also be coming on the heels of Ather’s listing, and it will be intriguing to see the competitive dynamics between these two EV giants in the public markets.

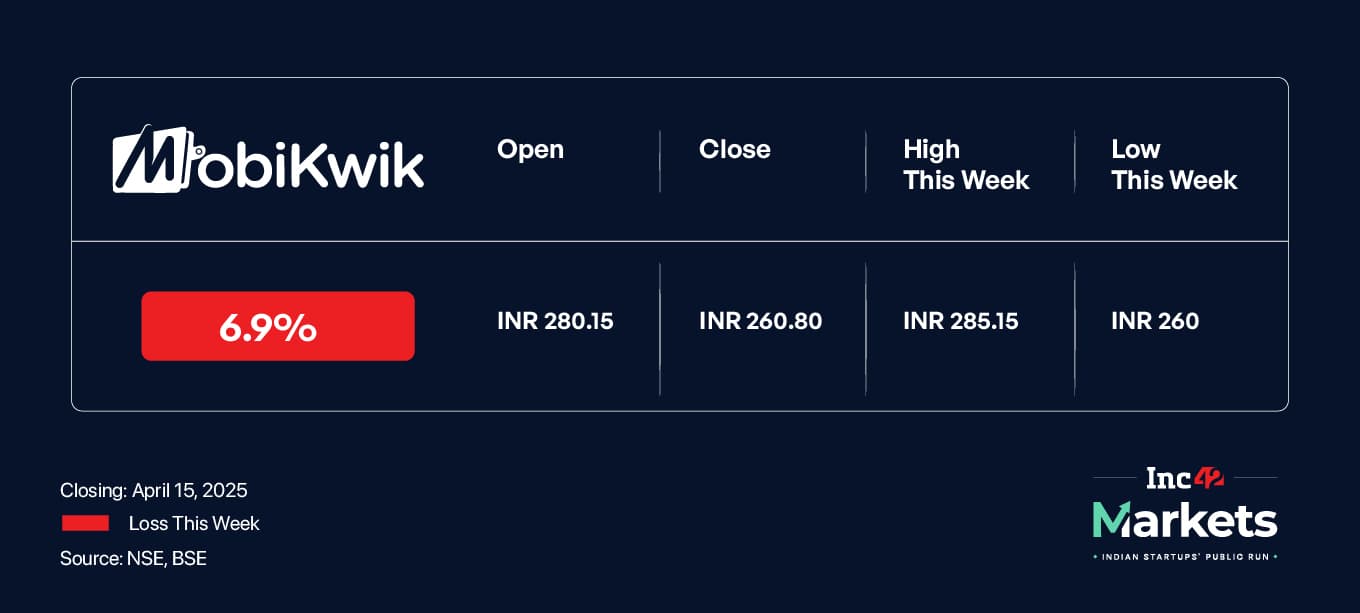

Stock In Focus: MobikwikMobiKwik’s which began after its listing continues unabated. Since the December quarter MobiKwik has put all its energy into new verticals such as a wealthtech platform along with a push towards insurance broking.

And this past week, the company incorporated a wholly-owned NBFC, but . The NBFC is expected to play a big part in the company’s loan business; however, the market’s reaction to the news was less than warm.

The MobiKwik stock has lost over 56% of its value since the start of the year and with competitive pressure only growing on the fintech company, there are some concerns that the revenue push is coming too late.

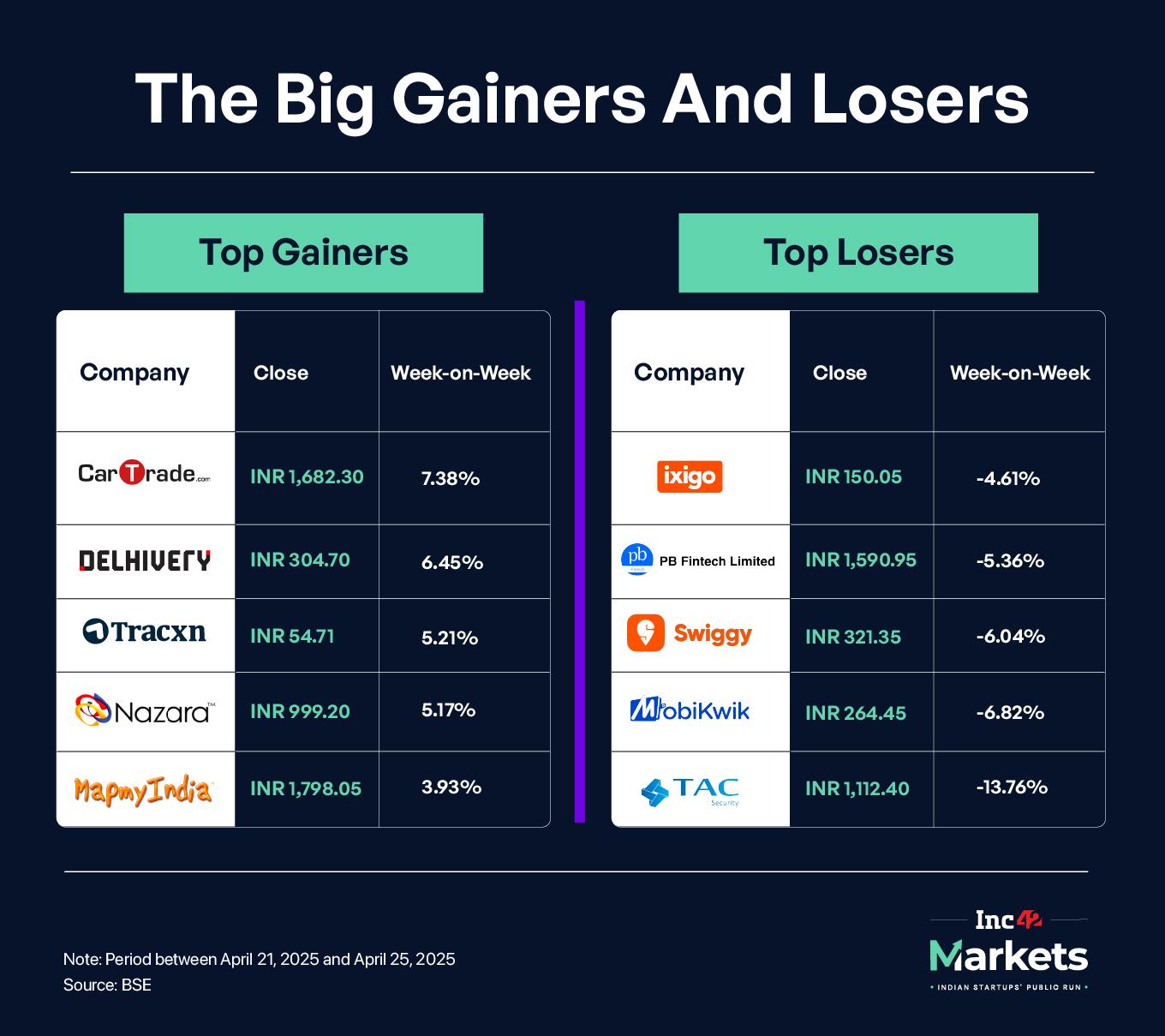

Swiggy and ixigo also had a week to forget on the stock markets, while CarTrade and Delhivery came out on top of the pile.

- In a fresh trouble for Ola Electric, the transport ministry has reportedly hauled up the EV maker over missing trade certificates

- Fintech major Pine Labs has elevated its chief executive officer, Amrish Rau to the dual role of managing director and chairman amid plans for an initial public offering worth $1 Bn

- Nitin Agarwal, CEO of FirstCry’s ecommerce roll-up arm GlobalBees, has stepped down from his role and will exit the parent company in another leadership shake-up at the ecommerce giant

- The Delhi High Court has issued a notice to Zomato and the CCI in connection with an ongoing antitrust investigation against the company

The post appeared first on .

You may also like

Jiggly Caliente dead: RuPaul's Drag Race star, 44, dies days after having leg amputated

Pope Francis funeral: The world leaders who took photos of coffin EXPOSED

Meghan Markle is a fan of one TV show that's relatable and loved by many

Celebrity Traitors stars pictured as they're whisked off to secret filming location

Louis Tomlinson's twin sisters' 'arguments' after signing for reality show