Mumbai: UltraTech Cement's fixed costs are set to reduce by around ₹100 per tonne sequentially in the current quarter helped by lower maintenance, advertising and staff expense, chief financial officer Atul Daga said. This is likely to reflect in the company's earnings before interest, tax, depreciation and amortization (EBITDA).

The country's largest producer of cement had an additional cost outgo of around ₹200 per tonne in the September quarter. The impact of kilns being shut down for a higher number of days led to an impact of around ₹100 per tonne, while higher advertising costs had an impact of around ₹15 per tonne.

The impact of increments and bonus payments was around ₹25 per tonne, while that of operating leverage was around ₹70 per tonne. "With all these items, there is a delta impact of around ₹200 per tonne," Daga said during a call with analysts after the company's September-quarter earnings. "It doesn't mean that these costs will not exist in the next quarter...there will be some element of cost, but not such a high impact," he said.

"With all these items, there is a delta impact of around ₹200 per tonne," Daga said during a call with analysts after the company's September-quarter earnings. "It doesn't mean that these costs will not exist in the next quarter...there will be some element of cost, but not such a high impact," he said.

"At least, ballpark (₹)100 will come down," Daga said.

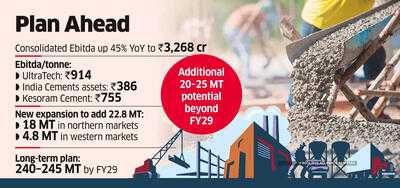

The cement major's EBITDA rose 45% on-year to ₹3,268 crore at a consolidated level. The EBITDA made on each tonne of cement stood at ₹914. The EBITDA per tonne for assets of India Cements was ₹386, while that of Kesoram Cement was ₹755 per tonne. Fresh Capacity

UltraTech will cross 200 million tonne of annual production capacity in the current fiscal, and has now announced its next leg of expansion which will add give it an additional 22.8 million tonnes of capacity.

"After completing our consolidation in the southern markets in fiscal 25, we have focused our guns on north and west," Daga said. "Out of this 22.8 million tonnes, 18 million tons is focused on the northern markets and 4.8 million tons for the western markets," he said.

While the company has currently outlined its plans to reach up to 240-245 million tonnes by fiscal 2029, there is scope for additional 20-25 million tonne of capacity coming on board beyond that.

"There will be possibilities of greenfield clinker-based units since we continuously keep acquiring mining rights and land acquisition is an ongoing process," Daga said.

The country's largest producer of cement had an additional cost outgo of around ₹200 per tonne in the September quarter. The impact of kilns being shut down for a higher number of days led to an impact of around ₹100 per tonne, while higher advertising costs had an impact of around ₹15 per tonne.

The impact of increments and bonus payments was around ₹25 per tonne, while that of operating leverage was around ₹70 per tonne.

"At least, ballpark (₹)100 will come down," Daga said.

The cement major's EBITDA rose 45% on-year to ₹3,268 crore at a consolidated level. The EBITDA made on each tonne of cement stood at ₹914. The EBITDA per tonne for assets of India Cements was ₹386, while that of Kesoram Cement was ₹755 per tonne. Fresh Capacity

UltraTech will cross 200 million tonne of annual production capacity in the current fiscal, and has now announced its next leg of expansion which will add give it an additional 22.8 million tonnes of capacity.

"After completing our consolidation in the southern markets in fiscal 25, we have focused our guns on north and west," Daga said. "Out of this 22.8 million tonnes, 18 million tons is focused on the northern markets and 4.8 million tons for the western markets," he said.

While the company has currently outlined its plans to reach up to 240-245 million tonnes by fiscal 2029, there is scope for additional 20-25 million tonne of capacity coming on board beyond that.

"There will be possibilities of greenfield clinker-based units since we continuously keep acquiring mining rights and land acquisition is an ongoing process," Daga said.

You may also like

BSF celebrates Diwali by lighting candles along India-Pakistan border in Jaisalmer

Tata in the spotlight: Two key Trust renewals this week as Srinivasan's term ends and Mehli Mistry awaits renewal

Katie Piper - 'Kindness Is the Real Superpower'

Festive sales season ends with a bang: Car, smartphone, and white goods purchases soar 50% compared to last year

Max Verstappen makes 'idiot' comment as Oscar Piastri and Lando Norris put on notice