NEW DELHI/MUMBAI: JK Lakshmi Cement and Chettinad Cement are bidding to acquire Telangana-based Deccan Cements, people aware of the talks told ET, as a state-driven infrastructure boom in neighbouring Andhra fuels demand for regional suppliers of the freight-heavy building material.

Deccan Cements, with an expected operational capacity of 4 million tonnes by the end of this year, is seeking an enterprise value of $360 million (Rs 3,110 crore) for the company, said the people aware of the discussions. That translates into about $90 for each tonne of capacity.

Replacement valuations in India's regionally divided cement industry differ rather widely, with greenfield expansions often costing above $100 a tonne. Valuations are generally more reasonable in southern India due to lower capacity utilisation and naked cement realisation (NCR) on each tonne of material sold.

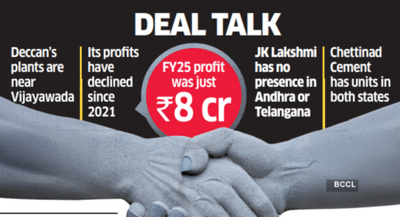

Deccan Cements' plants are located on the outskirts of Andhra Pradesh's second largest city of Vijayawada, although its corporate headquarters are in Hyderabad. The company is helmed by Parvathi Penmetcha.

Deccan has engaged EY for a potential sale, as per sources.

Andhra Pradesh's new capital city of Amaravati is fuelling a state-driven infrastructure boom in a region that has a significant number of integrated cement units. The Centre has unveiled projects worth Rs 50,000 crore for upgrading the state capital.

Deccan Cements, JK Lakshmi Cement, Chettinad Cement and EY did not respond to ET's queries on the subject until the publication of this report.

Delhi-based JK Lakshmi Cement has no manufacturing presence in Andhra Pradesh or Telangana. Chennai-based Chettinad Cement has manufacturing facilities in both states.

Stock Surge

Shares of Deccan Cements have surged nearly 66% so far in 2025, hitting their lifetime high of Rs 1,125 earlier this month.

The company has been seeing a steady decline in profits since 2021, with the full-year profit for fiscal 2025 at a mere Rs 8 crore on sales of Rs 527 crore. It had a net cash outgo of Rs 87 crore for the year. It's earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne of cement produced was Rs 489 in financial year 2023-24. This compares poorly with industry average EBITDA of Rs 900-1200 per tonne. Industry watchers cautioned that larger players have benefits of scale.

India's cement sector has been seeing consolidation since fiscal 2023, with market leader UltraTech Cement and the second-largest Adani Group buying most of the assets. This consolidation has been concentrated in the southern markets of India, which account for almost one-third of the total production in the country.

The demand for cement in the country has been robust over the last few years. In anticipation of this to rise further, most cement producers in the country are aggressively expanding capacities.

Deccan Cements, with an expected operational capacity of 4 million tonnes by the end of this year, is seeking an enterprise value of $360 million (Rs 3,110 crore) for the company, said the people aware of the discussions. That translates into about $90 for each tonne of capacity.

Replacement valuations in India's regionally divided cement industry differ rather widely, with greenfield expansions often costing above $100 a tonne. Valuations are generally more reasonable in southern India due to lower capacity utilisation and naked cement realisation (NCR) on each tonne of material sold.

Deccan Cements' plants are located on the outskirts of Andhra Pradesh's second largest city of Vijayawada, although its corporate headquarters are in Hyderabad. The company is helmed by Parvathi Penmetcha.

Deccan has engaged EY for a potential sale, as per sources.

Andhra Pradesh's new capital city of Amaravati is fuelling a state-driven infrastructure boom in a region that has a significant number of integrated cement units. The Centre has unveiled projects worth Rs 50,000 crore for upgrading the state capital.

Deccan Cements, JK Lakshmi Cement, Chettinad Cement and EY did not respond to ET's queries on the subject until the publication of this report.

Delhi-based JK Lakshmi Cement has no manufacturing presence in Andhra Pradesh or Telangana. Chennai-based Chettinad Cement has manufacturing facilities in both states.

Stock Surge

Shares of Deccan Cements have surged nearly 66% so far in 2025, hitting their lifetime high of Rs 1,125 earlier this month.

The company has been seeing a steady decline in profits since 2021, with the full-year profit for fiscal 2025 at a mere Rs 8 crore on sales of Rs 527 crore. It had a net cash outgo of Rs 87 crore for the year. It's earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne of cement produced was Rs 489 in financial year 2023-24. This compares poorly with industry average EBITDA of Rs 900-1200 per tonne. Industry watchers cautioned that larger players have benefits of scale.

India's cement sector has been seeing consolidation since fiscal 2023, with market leader UltraTech Cement and the second-largest Adani Group buying most of the assets. This consolidation has been concentrated in the southern markets of India, which account for almost one-third of the total production in the country.

The demand for cement in the country has been robust over the last few years. In anticipation of this to rise further, most cement producers in the country are aggressively expanding capacities.

You may also like

Venezuela-US prisoner swap: Freed American was serving 30-year sentence for triple murder; US aware of conviction

James Comey blasts US government: Ex-FBI director lashes out in daughter's defence after DOJ dismissal; warns of 'hard weeks in Trump era'

World IVF Day 2025: Women should not make these 6 mistakes during IVF treatment, it will cause harm..

Hulk Hogan's worrying health issue in final weeks as WWE star dies suddenly

Migration protest LIVE: Canary Wharf hotel set for protests as cops erect 'ring of steel'