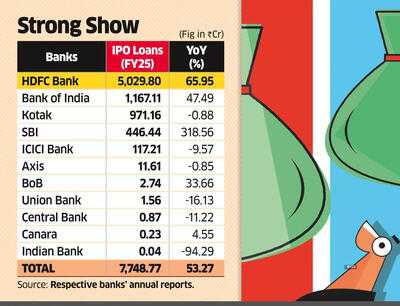

Banks' funding to individuals for buying shares in initial public offerings surged 53% last fiscal year as they sought to capitalise on a growing trend of companies tapping the capital market.

State Bank of India tripled its IPO financing portfolio to ₹446 crore in FY25, showed an ET analysis.

HDFC Bank sustained its dominance of this thriving market, ending the year with a ₹5,029-crore loan book, followed by Bank of India at ₹1,167 crore.

Typically, banks provide up to ₹10 lakh per borrower at rates ranging between 9% and 10% for a period of 5 to 7 days. Some offer a longer duration of 30 to 90 days. Shares received by individuals from IPOs serve as collateral against the loans.

Sebi's annual report showed 322 companies raised ₹1.9 lakh crore through IPOs in FY25, up from the ₹68,000 crore raised by 273 companies in the year before.

Sixteen banks covering 90% of the banking sector extended ₹7,748 crore loans towards IPO financing in FY25, the analysis showed.

However, the actual market is likely to be larger with some banks providing IPO loan facilities through their respective subsidiaries. Several independent non-banking financial companies are also providing similar loan facilities.

In its latest annual report, released on May 29, the Reserve Bank of India too appeared optimistic about the new public issuances. "Resource mobilisation through the primary market is expected to regain momentum as secondary market sentiments stabilise. In the short-run, however, markets may experience volatility reflecting global policy uncertainty," RBI said.

State Bank of India tripled its IPO financing portfolio to ₹446 crore in FY25, showed an ET analysis.

HDFC Bank sustained its dominance of this thriving market, ending the year with a ₹5,029-crore loan book, followed by Bank of India at ₹1,167 crore.

Typically, banks provide up to ₹10 lakh per borrower at rates ranging between 9% and 10% for a period of 5 to 7 days. Some offer a longer duration of 30 to 90 days. Shares received by individuals from IPOs serve as collateral against the loans.

Sebi's annual report showed 322 companies raised ₹1.9 lakh crore through IPOs in FY25, up from the ₹68,000 crore raised by 273 companies in the year before.

Sixteen banks covering 90% of the banking sector extended ₹7,748 crore loans towards IPO financing in FY25, the analysis showed.

However, the actual market is likely to be larger with some banks providing IPO loan facilities through their respective subsidiaries. Several independent non-banking financial companies are also providing similar loan facilities.

In its latest annual report, released on May 29, the Reserve Bank of India too appeared optimistic about the new public issuances. "Resource mobilisation through the primary market is expected to regain momentum as secondary market sentiments stabilise. In the short-run, however, markets may experience volatility reflecting global policy uncertainty," RBI said.

You may also like

Radha Ashtami 2025: Are you fasting for the first time? First know these things, rules and necessary precautions..

How did the networks of mobile companies come to a standstill at the same time? People expressed their displeasure on the Internet

Chelsea plan nine-player firesale including desperate Raheem Sterling move

Investment Tips: Open this account in the name of your children with amazing returns! You will get 1 crore after 25 years, know the process..

You can become rich through WhatsApp. Earning is very easy. Know the way to earn money